The proliferation of digital usage has imposed digital innovations on insurance companies to offer their customers a diversification of touchpoints.

Home » Life Insurance software

Your life insurance issues

With changing expectations and practices, health insurers, provident institutions and mutual insurance companies need to accelerate the marketing of innovative, customized offerings. Your life insurance software for managing individual and group policies must be reliable, efficient and flexible to meet the high demands of individuals and businesses. It must also support your digital transformation strategy by integrating seamlessly with your existing information system.

Stand out from the crowd by easily creating value-added offers.

Life insurance Business

Manage the entire lifecycle of your insurance contracts on a single cloud platform: product design, underwriting process, claims management, reinsurance management, accounting.

Adaptable

You can independently develop new processes, according to the specificities of the covered lines of business, without the risk of interfering with the core of Ciriselsa VIE.

The insurance VIE software natively allows the creation and management of multilingual, multi-currency, multi-alphabet and multi-tax health and social security policies, both for individuals and groups.

Your insurance software is hosted in the cloud, which guarantees optimal performance as your workload increases (increase in functionality, creation of new agencies, increase in volume of files managed, etc.).

Our solution adapts to all the specificities of your business and market with our pluggable processes.

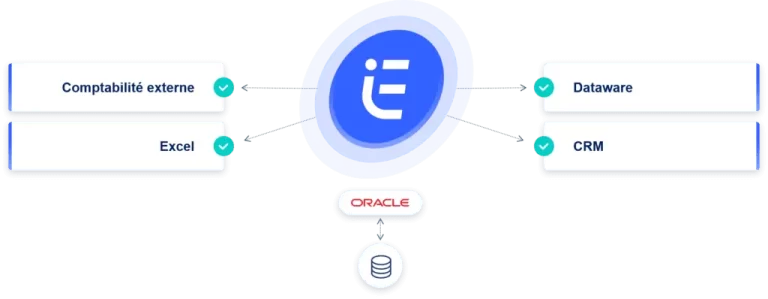

Ciriselsa interfaces with external reference platforms (data, digital, IoT, CRM, BI, accounting) for global management of your activities and automation of low value-added tasks.

"The architecture of the Ciriselsa IARD management platform allows us to be totally autonomous in our developments, without interfering in the core software. Infoelsa has always supported us, at our request and when necessary, with advice, relevant assistance, and an unfailing commitment to simplifying the tasks of configuration, administration and deployment."

"We have been using the Ciriselsa IARD management platform for several years now to manage all of Allianz France's aviation lines of business (light aviation, business aviation, civil and professional liability for pilots, etc.). Ciriselsa is the perfect answer to the complexities of our market contexts, thanks to the flexibility, adaptability, openness and reliability of its system."

"We use the Ciriselsa IARD management platform to manage the insurance contracts of the transport branch. Ciriselsa has easily interfaced with our internal information system that manages the company's other businesses. We appreciate the flexibility and robustness of the software, as well as the reliability, trust and service spirit of its publisher, Infoelsa."

The proliferation of digital usage has imposed digital innovations on insurance companies to offer their customers a diversification of touchpoints.

Thanks to data and an entry ticket that is decreasing as it becomes more widespread, digital innovation is more than

For a long time, the insurance industry has followed the market on its own timetable because of its mission, where

« Making health insurance affordable and accessible for all ages » by SafetyNet As a health insurance specialist working

The life insurance (Health and Provident) software is a business management solution for the personal insurance sector (insurance companies, mutual health insurers, provident funds, brokers and managing agents).

The life insurance (Health and Provident) software manages new quote creation, online subscriptions, claims reporting, customer relations, policy life and reinsurance contract management.

Life insurance software is an indispensable tool in the digital transformation strategy of the life and health insurance industry. It automates business processes, simplifies the customer journey and ensures exchanges between the various players in the health insurance industry.

To offer insurance professionals insurance management software that matches their ambitions.